Extravagant Surge in Luxury Watch Prices

The world of luxury watches, encompassing esteemed brands like Rolex, Audemars Piguet, and Patek Philippe, has long been synonymous with high prices. However, in recent times, there has been an unprecedented surge in prices that surpasses even the usual expectations. If you find yourself entering the watch market in 2021 or 2022, or seeking to purchase a luxury timepiece for yourself or a loved one, you are likely to have numerous questions about the exorbitant prices you encounter. Why are these watches so expensive? Why are they selling above retail price? Should you consider buying on the grey market? Allow me to shed some light on these matters as we explore the reasons behind these skyrocketing prices.

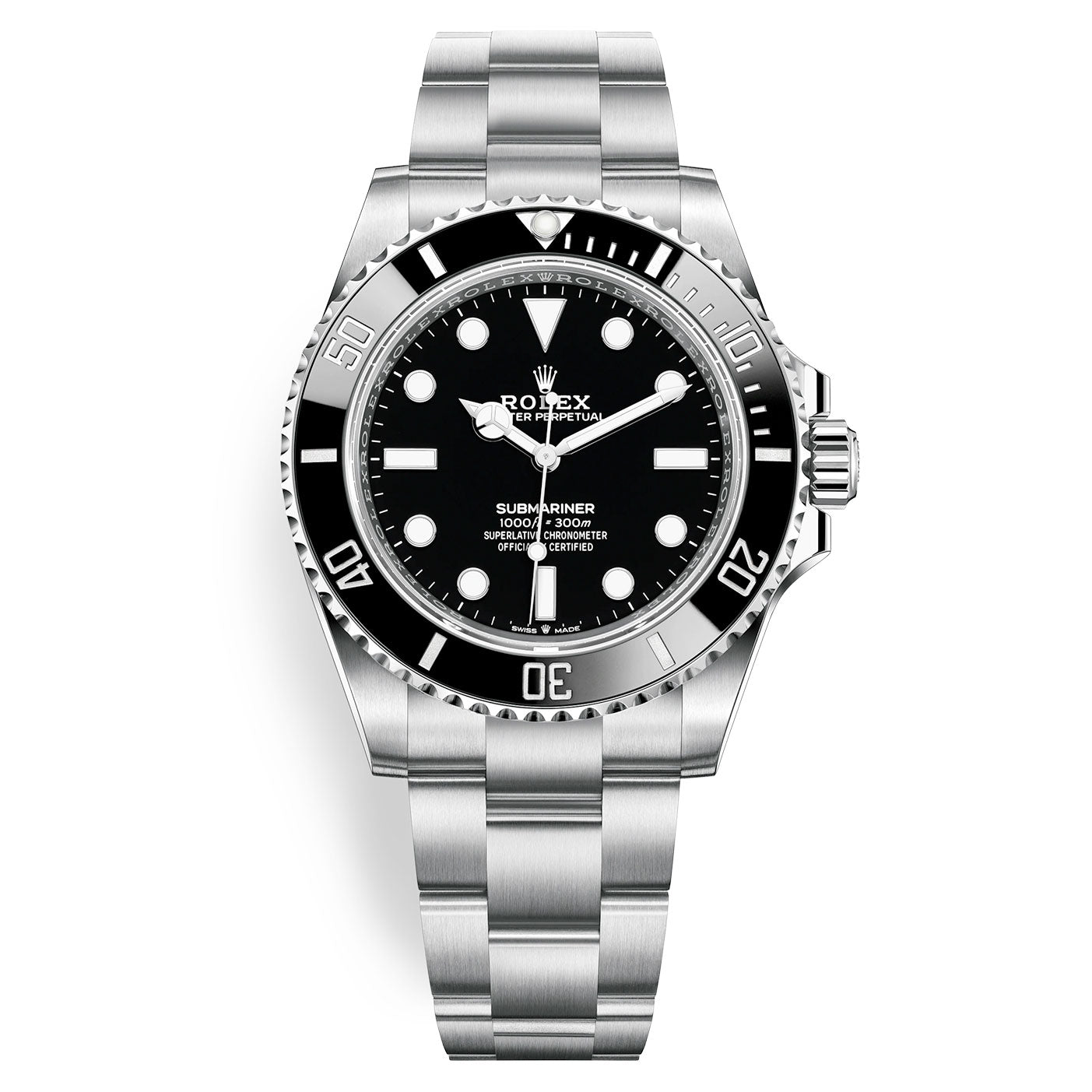

Supply and demand dynamics play a significant role in the steep price tags of luxury watches. The demand for these timepieces far surpasses the available supply, resulting in a scarcity that drives up their value. It is not uncommon to walk into a Rolex retailer and find a limited selection of watches, or even none at all, despite what may be displayed on their website. Brands like Audemars Piguet and Patek Philippe produce even fewer watches than Rolex, with some accusing them of intentionally restricting supply to maintain exclusivity and elevate their products' value. In contrast, brands like Omega offer relatively more accessible timepieces due to their higher production volumes.

To maintain a sense of exclusivity, certain brands release new watch lines in extremely limited quantities. For instance, there may be as few as 300 timepieces available for a specific model, adding to their desirability and luxury appeal. However, this practice can often lead to disappointment for customers who encounter empty displays or only find models they are not interested in at their nearest authorized dealers.

Another factor contributing to the surge in prices is the rise of unfair package deals. Authorized dealers often require customers to purchase less desirable timepieces at full retail price before considering them eligible for highly sought-after models like the Rolex Daytona, Patek Philippe Nautilus, or Audemars Piguet Royal Oak. These package deals force buyers to compromise by acquiring a watch they don't truly desire to gain access to their coveted timepiece. This practice has been criticized as unfair, as customers essentially assist dealers in selling less desirable watches to secure a chance at owning their preferred model.

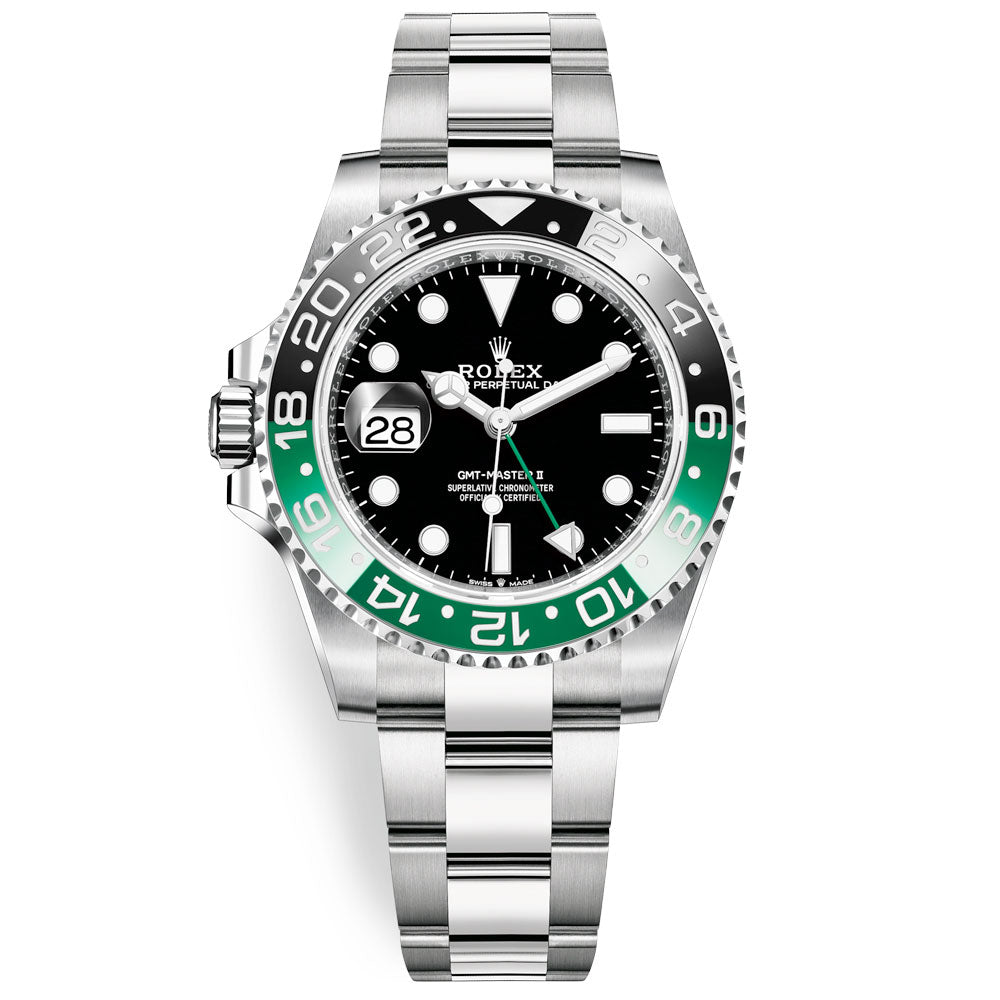

The impact of the COVID-19 pandemic has also had an interesting effect on the luxury watch market. Contrary to expectations, the demand for luxury watches did not decrease significantly during lockdowns or reduced social activities. In fact, brands like Rolex and Patek Philippe witnessed a significant surge in demand for certain models, particularly entry-level stainless steel watches. This unexpected trend may be attributed to the fact that with limited travel and entertainment options available, people redirected their discretionary spending towards luxury items like watches. Moreover, disruptions in manufacturing during the pandemic resulted in lower production levels, further contributing to the allure and desirability of these coveted timepieces.

While the reasons behind the rapid increase in luxury watch prices may seem complex and multifaceted, it ultimately boils down to the interplay between supply and demand, brand strategies to maintain exclusivity, unfair sales practices, and the unique circumstances brought about by the COVID-19 pandemic. As you navigate the world of luxury watches, it's crucial to be aware of these factors and make informed decisions based on your preferences, budget, and values.